Catch up on the latest news and updates

Subscribe To Our Newsletter

Insights on R&D tax credits and AI innovation delivered to your inbox every month.

Featured Collection

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.

Medium length section heading goes here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Medium length section heading goes here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

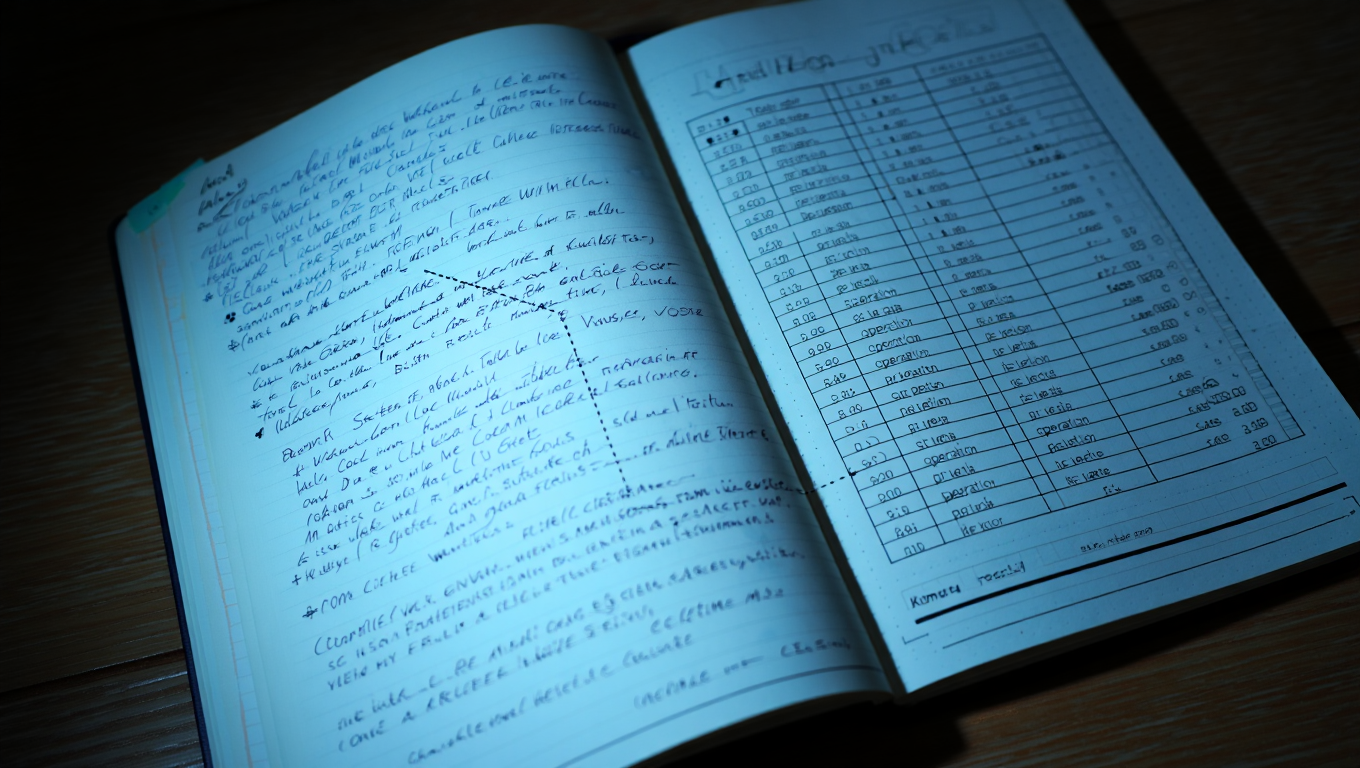

Why Neo.Tax Built An Audit Log

How Neo.Tax's AI Understands Ticketing Data

No items found.